Wellfie Wednesday Tip #121: The Greatest Trick Ever Pulled

/This week’s #WellfieWednesday is brought to you by Aaron Perez (@FreestylePhysio). Enjoy!

As I scrolled through my twitter feed Tuesday night procrastinating the writing of this blog I came across some inspiration. I had no intentions of writing a heavy post about the ongoing healthcare crisis in America, but the Vox article reminded me just of how dire the situation is. To quote Dave Chase, “Healthcare stole the American dream.” This morning I was onsite at an employer and overheard a presentation regarding the company’s open enrollment for healthcare benefits. I couldn’t help but feel like most people in the room including myself have no idea just how much we pay for healthcare. It reminds me of a well-known quote from The Usual Suspects which inspired the title of this blog, “The greatest trick the devil ever pulled was convincing the world he didn’t exist.” However, in this case the quote might go something like “The greatest trick healthcare ever pulled was convincing Americans they don’t pay for healthcare.” However, thanks to soaring out of pocket costs by way of rising deductibles (212% increase over the past decade compared to 26% increase in wage growth), more and more of us are quickly realizing. They say a picture is worth 1,000 words. So, rather than me ramble on and on, below are some pictures and graphs I feel tell the tale well. If you’re looking for more of a deep dive, Dave Chase and David Goldhill do a much better job than I ever could.

Ways We Pay

We pay in skyrocketing deductibles and premiums relative to wage growth.

Source: https://www.kff.org/health-costs/report/2018-employer-health-benefits-survey/

We pay when millennials can expect to see half of their lifetime earnings go towards healthcare (and that was a conservative estimate).

Source: Catastrophic Care by David Goldhill

We pay when medical errors are the 3rdleading cause of death nationwide.

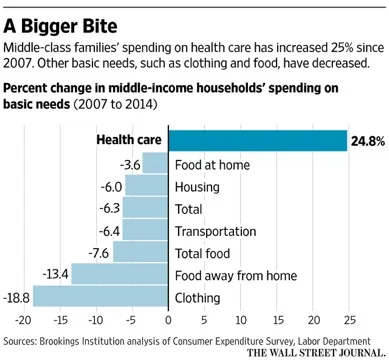

We pay when we sacrifice basic needs to pay for a dysfunctional healthcare system.

Source: https://www.wsj.com/articles/burden-of-health-care-costs-moves-to-the-middle-class-1472166246

We pay in poorer health and shorter life expectancy.

We pay by spending more on healthcare than social services.

We pay big time for worse health outcomes.

So, when will we get our return on investment? I’m not holding my breath for that moment to come. I feel like this post was a bit of a Debby-downer to say the least. That’s not typical for our #WellfieWednesday blogs, but I feel it was appropriate. On a more positive note, I hope this post raises some awareness and more so that it evokes a desire for change. Things will change, they always do. Cheers to those fighting to make that change be a positive one. I greatly admire your efforts and I’m in this with you.

Thanks for all of the support, be sure to post your pictures this week and tag the WW crew members in your post (@TheFuelPhysio, @Eric_in_AmERICa, @FreestylePhysio, @DianaKlatt) and keep the wave of healthy change going!

-WW Crew